On one hand you have the “ money is the root of all evil” crowd who want to convince you that not having money is a sign of some sort of piety and that you should wear poverty proudly and not want for something more. The crowd that says I could’ve been rich, but I chose a more spiritual route. As if to say that you can not have money and be spiritual at the same time. If your family was like mine, you did not discuss money at home. Your parents’ incomes were a private matter that you were not privy to and, if you asked, would get you firmly put in your place. Money was a dirty thing that was scarce and hard to get. It required long hours at a place that you hated to go to with people you could not stand to be around. And family was a great thing, but having one meant never being financially free.

On the other hand there is the “lack of money is the root of all evil” crowd who know from experience the evil that the lack of money can cause a person to do. The crowd that says “I am rich” even when they are flat broke. The group of people whose actions reflect a desire to have more so that they can do more. Any one who believes that spiritual accomplishment can be run penniless has never had to fund a mission to a third world country or build a school in economically challenged area.

So which one is right? Neither. But what I have found is that the profound difference between the “haves” and “have-nots” lies exclusively with money. I’m not talking about the number of figures in your pay check or the balance in your check book. I’m talking about the attitude toward and understanding of money. The “haves” rarely make excuses for not having money; they find solutions to the problem and create money. The old adage “it takes money, to make money” is a fallacy for them. This group of people can make money from nothing with just their creativity and will power.

So what is this magic been that separates the “haves” from the “have-nots?” It is education, the financial education that you won’t get from any academic institution. You have to seek out and nurture this education out side of the standard school system. And you are never too young or too old to get this education.

While I could write volumes on the subject, and in fact there are hundreds upon hundreds of books on the different facets of money, let me give just a few financial truths.

Money DOES Grow On Trees.

You can literally find money nearly everywhere in everything. EBay is a prime example of this. EBay is a place where any one can sell their every day junk and make money or set up a virtual store and make money from nothing. This is just one example of how some one took an idea and turned it into a money tree that creates money with out them having to work harder. My daughter has a candy machine business; she spends maybe 10 minutes a week working at but makes her more money every month than she makes at her JOB. That machine is her money tree. Just like a real tree it took a little time to find the right spot with all the right conditions, to figure out what was the best “fruit” for that area and then to care for the “tree”. And just like a real tree, the money tree will continue to grow and provide long after you stop working hard on it.

Ask yourself, ‘what is, or could be my money tree?’ Now go grow it.

Your Banker Will NEVER Ask For Your School Report Card Or Ask To See Your Permanent Academic Record.

Once you finish your academic career, your report card and permanent record will mean very little. Yes, you may have a degree that qualifies you for a higher paying job…maybe. (65% of all college graduates do not obtain employment in their field of study.) And you will have a higher earning potential that some of your class mates who did not manage to obtain a degree…maybe. (The job market is flooded with college graduates who can not find a work in their field of study, so they end up in another field making less money.) But what will that piece of paper and tens of thousand of dollars really do for you? Consider this: information is doubling every eighteen months. At that rate by the third year of your four year degree, what you studied in years one and two will be obsolete. When you leave school, the report card that you received every quarter will no longer show you your progress and help you to realign your priorities. I have never once had an employer or any other person that I wished to do business with, ask to see my permanent academic record. I have never been turned down for a business deal because I failed 9th grade algebra or got suspended for fighting in the girls gym in the 7th grade. I have, however been asked for my work records by potential employers and I have been asked for my financial statements by banks and potential business partners. After you get out of school, your financial statements become your report card. I find it frightening that in a world where your financial statement is your real life report card, we are taught next to nothing about the subject of money in school.

Take your accountant to lunch and pick his or her brain. You will learn a lot just by talking and it will only cost you the price of a lunch.

You CAN Afford Anything That You Want

I hear every day from people all over the place four little words that hold them back so much more than they will probably ever realize. “I Can’t Afford It”

The word ‘can’t’ in that statement is an absolute to our wonderfully complex brains, which does something horribly restrictive. It sends our brains a signal that tells it “this is it, you don’t have to work any more, because there is nothing else to it. “I can’t afford it” is a statement which automatically causes the brain to stop working. What the “haves” do that the “have-nots” don’t do is add one word, change one word and change the order so that the brain begins to work and get creative. They ask a question…”How Can I Afford It?” We all have the ability to afford anything that we want; we just have to find the how.

Charity Does Come Back To You Multiplied

Imagine a twenty dollar bill in your hand and your fist closed tightly around it. Could some one get that money out of your hand? Yes, but not with out great difficulty. On the reverse of that, they could not very easily put more money into your hand either.

Now imagine that same twenty dollar bill lying in your open hand. It is easy for that money to be removed from your hand and just as easy to put more money into it.

When we are charitable, we open out hands and minds to increase our money making power as well as feeding our spirit. Generosity breeds an openness that allows us to receive the generosity of others.

Assets Put Money IN Your Pocket . (Not Matter What Your Banker Tells You)

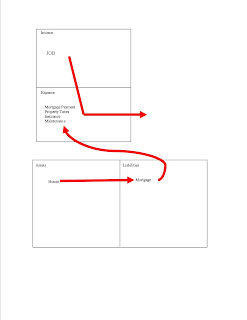

One of the biggest reasons that accounting is confusing for most people is because it defines items in one way and classifies them in another. For example an asset, in its simplest definition is something that puts money in your pocket. And a liability takes money out of your pocket. However when we go to the bank and are asked to fill out a financial statement, things like TV’s , personal homes, personal vehicles are all listed under the asset column even though those items do not generate income and in fact take money out of your pocket every month for years and sometimes decades. The question is often debated as to whether or not a personal residence is an asset or a liability. To answer that question lets go back to the definitions of an asset and a liability. If an asset puts money in your pocket and a liability takes money from your pocket. And the cash flow pattern of your house looks like this:

Then your house is really a liability.

When your banker says that your home is an asset he/she is not lying, they are just not telling you whose asset it is. The illustration below explains this point.

JOB Is An Acronym

It stands for Just Over Broke. If all you have is just a job all you will ever be is just over broke.

Cash Flow Determines Your Financial Class And Your Choices Determine Your Cash Flow.

The illustration above contains red arrows that represent the direction of cash flow. And cash flow is one of the most important financial concepts that you can master, because it is your cash flow pattern, not how much money you make, that determines whether you are rich , middle class or poor. The choices that you make with your money determine your cash flow pattern. Change your choices, change your cash flow pattern. Change your cash flow pattern, change your financial class.

The poor choose to spend all of their money on expenses. Living expenses, new toys, vacations, etc. I have seen people with six figure incomes have this cash flow pattern.

The Middle Class choose to spend their money on liabilities that siphon all of their money out the expense column. The more money they make the more debt they incur and the harder they have to work to pay for that debt.

The Rich also spend their money on expenses and liabilities, but in a different order than the poor and middle class. The rich FIRST CHOOSE to spend their money on ASSETS ( that put money in their pockets with out them having to continue to work hard) then they spend their money on expenses and lastly on liabilities.

And a personal favorite though not exclusively financial,

Dream Big And Then Go For It.

Let your dreams be your driving force . DREAM BIG!! Let your imagination shape your journey to creating your own reality and then TAKE ACTION! Do at least one thing every day to make that dream a reality. We hold our selves back by allowing other people to tell us what is possible or impossible. If you decide that you can do anything, then you CAN do anything. Henry Ford once said “ if you think you can or if you think that you can’t, you’re right”. Believe that you can, and then do it.