I spent an evening at a master mind group several weeks ago during which the conversation turned to a business opportunity that one of the other members had been presented with. the opportunity to purchase a well known sandwich franchise. This member went on to tell us how the sales rep for the franchise printed a very pretty picture for them and did his job very well. after the sales presentation the member and spouse were nearly ready to sign the contract and get started. Fortunately this couple had the forethought to involve their accountant in this process and after examining the financial statements found that the business was actually loosing money consistently. The couple decided not to purchase the franchise.

When was the last time that you involved your accountant in one of your financial decisions?

By involving their accountant, this couple saved themselves from purchasing a franchise that would have eaten them alive because it kept loosing money.

the next time that you are looking to make a purchase, ask yourself, do i have all of the information I need to make a well informed decision on this, and will this bring me closer to my goal.

for my colleague, the answer to both questions was no. To make sure that they had all of the information necessary, the couple sought help. Once the discovery was made that the franchise was loosing money, the answer to the second question became obvious. knowingly loosing money on an investment was not an intelligent decision for them because it did not bring them closer to the goal of creating more income from their investments.

Remember, before you make a financial decision, get all of the information. if you are not sure that you have all of the information, ask a trusted professional or other person with successful experience doing what you are trying to do.

Finally ask yourself does this take me closer to my goals? Make sure that you have clear and specific goals, or you will not be able to accurately answer this question.

To your dream life style,

Dannielle Fritz-MacDuff

Jade Financial Services & Tax Preparation Inc.

info@jadefinancialservices.com

330.299.0229

Monday, August 20, 2007

Knowlege Reposting

I was discussing success with a colleague the other day and he mentioned that at the root of the word, success simply means to take action. after that discussion I thought that I would re-post this specific article for those of you who missed it the first time around.

Knowledge is NOT Power.

I have often wondered why so many people struggle financially in this day of abundant free information. We have resources on the Internet, libraries are offering more and more programs as well as newer books about any subject that you could imagine, all of which are free. So why is it that so many people struggle or complain about struggling when there are so many sources of free knowledge? After all, knowledge is power, right? Well, not so much. Knowledge in itself does not hold any power, It is the application of that knowledge that unleashes the unstoppable human spirit. Think about this; we all know that eating healthier foods and exercising regularly is key to keeping our bodies and minds healthy, however how many of us really take action on that knowledge. We also know (at least on some subconscious level) that investing our money to make money for us instead of working harder for money is a much better way to pay for our living expenses. Yet the majority of us still work very hard to get our selves into debt that requires us to work harder to pay for those debts. We know that what we are doing is not working all that well for us, but we choose to either not learn more about how to make our money work hard for us or to not take action to change our situation. Knowledge is only the first step to creating wealth, the next step is to take action. So, where do you start? Try the library, you will find free Internet access, books on CD or cassette, videos, DVDs, and of course books, all of which can help you learn more about your money. Next, seek out a professional who specializes in the area in which you are most interested and pick his/her brain, most of the time this can be done for no cost or maybe the cost of lunch. Small price to pay for the knowledge that gives you more options. Finally, TAKE ACTION!! Don't sit around telling your self that you will do something someday. "When I get some extra money" When I have extra time" These scenarios never , and I mean NEVER, happen. There will always be some reason why you can't do something,if you look you will find a reason. If you look a little harder, you will find a reason why and how you can accomplish your dreams. My Grandmother used to say " Danni, If you dig in the ground, you're bound to find dirt". Why dig in the ground for some reason not to make our futures brighter, when the sky is the limit and the pot of gold really is at the end of your rainbow.

From your financial freedom coaches

Dannielle Fritz-MacDuff

Jade Financial Services & Tax Preparation Inc

info@jadefinancialservices.com

33.299.0229

Knowledge is NOT Power.

I have often wondered why so many people struggle financially in this day of abundant free information. We have resources on the Internet, libraries are offering more and more programs as well as newer books about any subject that you could imagine, all of which are free. So why is it that so many people struggle or complain about struggling when there are so many sources of free knowledge? After all, knowledge is power, right? Well, not so much. Knowledge in itself does not hold any power, It is the application of that knowledge that unleashes the unstoppable human spirit. Think about this; we all know that eating healthier foods and exercising regularly is key to keeping our bodies and minds healthy, however how many of us really take action on that knowledge. We also know (at least on some subconscious level) that investing our money to make money for us instead of working harder for money is a much better way to pay for our living expenses. Yet the majority of us still work very hard to get our selves into debt that requires us to work harder to pay for those debts. We know that what we are doing is not working all that well for us, but we choose to either not learn more about how to make our money work hard for us or to not take action to change our situation. Knowledge is only the first step to creating wealth, the next step is to take action. So, where do you start? Try the library, you will find free Internet access, books on CD or cassette, videos, DVDs, and of course books, all of which can help you learn more about your money. Next, seek out a professional who specializes in the area in which you are most interested and pick his/her brain, most of the time this can be done for no cost or maybe the cost of lunch. Small price to pay for the knowledge that gives you more options. Finally, TAKE ACTION!! Don't sit around telling your self that you will do something someday. "When I get some extra money" When I have extra time" These scenarios never , and I mean NEVER, happen. There will always be some reason why you can't do something,if you look you will find a reason. If you look a little harder, you will find a reason why and how you can accomplish your dreams. My Grandmother used to say " Danni, If you dig in the ground, you're bound to find dirt". Why dig in the ground for some reason not to make our futures brighter, when the sky is the limit and the pot of gold really is at the end of your rainbow.

From your financial freedom coaches

Dannielle Fritz-MacDuff

Jade Financial Services & Tax Preparation Inc

info@jadefinancialservices.com

33.299.0229

Wednesday, June 20, 2007

Money: What They Don’t Teach You In School by Dannielle Fritz-MacDuff

Let’s talk about money, that almost four letter word that is the subject of so much controversy.

On one hand you have the “ money is the root of all evil” crowd who want to convince you that not having money is a sign of some sort of piety and that you should wear poverty proudly and not want for something more. The crowd that says I could’ve been rich, but I chose a more spiritual route. As if to say that you can not have money and be spiritual at the same time. If your family was like mine, you did not discuss money at home. Your parents’ incomes were a private matter that you were not privy to and, if you asked, would get you firmly put in your place. Money was a dirty thing that was scarce and hard to get. It required long hours at a place that you hated to go to with people you could not stand to be around. And family was a great thing, but having one meant never being financially free.

On the other hand there is the “lack of money is the root of all evil” crowd who know from experience the evil that the lack of money can cause a person to do. The crowd that says “I am rich” even when they are flat broke. The group of people whose actions reflect a desire to have more so that they can do more. Any one who believes that spiritual accomplishment can be run penniless has never had to fund a mission to a third world country or build a school in economically challenged area.

So which one is right? Neither. But what I have found is that the profound difference between the “haves” and “have-nots” lies exclusively with money. I’m not talking about the number of figures in your pay check or the balance in your check book. I’m talking about the attitude toward and understanding of money. The “haves” rarely make excuses for not having money; they find solutions to the problem and create money. The old adage “it takes money, to make money” is a fallacy for them. This group of people can make money from nothing with just their creativity and will power.

So what is this magic been that separates the “haves” from the “have-nots?” It is education, the financial education that you won’t get from any academic institution. You have to seek out and nurture this education out side of the standard school system. And you are never too young or too old to get this education.

While I could write volumes on the subject, and in fact there are hundreds upon hundreds of books on the different facets of money, let me give just a few financial truths.

Money DOES Grow On Trees.

You can literally find money nearly everywhere in everything. EBay is a prime example of this. EBay is a place where any one can sell their every day junk and make money or set up a virtual store and make money from nothing. This is just one example of how some one took an idea and turned it into a money tree that creates money with out them having to work harder. My daughter has a candy machine business; she spends maybe 10 minutes a week working at but makes her more money every month than she makes at her JOB. That machine is her money tree. Just like a real tree it took a little time to find the right spot with all the right conditions, to figure out what was the best “fruit” for that area and then to care for the “tree”. And just like a real tree, the money tree will continue to grow and provide long after you stop working hard on it.

Ask yourself, ‘what is, or could be my money tree?’ Now go grow it.

Your Banker Will NEVER Ask For Your School Report Card Or Ask To See Your Permanent Academic Record.

Once you finish your academic career, your report card and permanent record will mean very little. Yes, you may have a degree that qualifies you for a higher paying job…maybe. (65% of all college graduates do not obtain employment in their field of study.) And you will have a higher earning potential that some of your class mates who did not manage to obtain a degree…maybe. (The job market is flooded with college graduates who can not find a work in their field of study, so they end up in another field making less money.) But what will that piece of paper and tens of thousand of dollars really do for you? Consider this: information is doubling every eighteen months. At that rate by the third year of your four year degree, what you studied in years one and two will be obsolete. When you leave school, the report card that you received every quarter will no longer show you your progress and help you to realign your priorities. I have never once had an employer or any other person that I wished to do business with, ask to see my permanent academic record. I have never been turned down for a business deal because I failed 9th grade algebra or got suspended for fighting in the girls gym in the 7th grade. I have, however been asked for my work records by potential employers and I have been asked for my financial statements by banks and potential business partners. After you get out of school, your financial statements become your report card. I find it frightening that in a world where your financial statement is your real life report card, we are taught next to nothing about the subject of money in school.

Take your accountant to lunch and pick his or her brain. You will learn a lot just by talking and it will only cost you the price of a lunch.

You CAN Afford Anything That You Want

I hear every day from people all over the place four little words that hold them back so much more than they will probably ever realize. “I Can’t Afford It”

The word ‘can’t’ in that statement is an absolute to our wonderfully complex brains, which does something horribly restrictive. It sends our brains a signal that tells it “this is it, you don’t have to work any more, because there is nothing else to it. “I can’t afford it” is a statement which automatically causes the brain to stop working. What the “haves” do that the “have-nots” don’t do is add one word, change one word and change the order so that the brain begins to work and get creative. They ask a question…”How Can I Afford It?” We all have the ability to afford anything that we want; we just have to find the how.

Charity Does Come Back To You Multiplied

Imagine a twenty dollar bill in your hand and your fist closed tightly around it. Could some one get that money out of your hand? Yes, but not with out great difficulty. On the reverse of that, they could not very easily put more money into your hand either.

Now imagine that same twenty dollar bill lying in your open hand. It is easy for that money to be removed from your hand and just as easy to put more money into it.

When we are charitable, we open out hands and minds to increase our money making power as well as feeding our spirit. Generosity breeds an openness that allows us to receive the generosity of others.

Assets Put Money IN Your Pocket . (Not Matter What Your Banker Tells You)

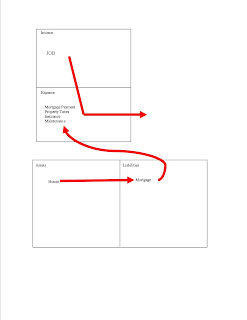

One of the biggest reasons that accounting is confusing for most people is because it defines items in one way and classifies them in another. For example an asset, in its simplest definition is something that puts money in your pocket. And a liability takes money out of your pocket. However when we go to the bank and are asked to fill out a financial statement, things like TV’s , personal homes, personal vehicles are all listed under the asset column even though those items do not generate income and in fact take money out of your pocket every month for years and sometimes decades. The question is often debated as to whether or not a personal residence is an asset or a liability. To answer that question lets go back to the definitions of an asset and a liability. If an asset puts money in your pocket and a liability takes money from your pocket. And the cash flow pattern of your house looks like this:

Then your house is really a liability.

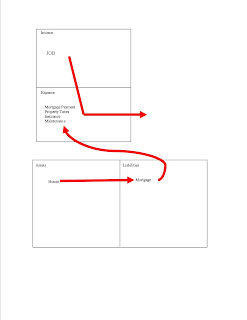

When your banker says that your home is an asset he/she is not lying, they are just not telling you whose asset it is. The illustration below explains this point.

JOB Is An Acronym

It stands for Just Over Broke. If all you have is just a job all you will ever be is just over broke.

Cash Flow Determines Your Financial Class And Your Choices Determine Your Cash Flow.

The illustration above contains red arrows that represent the direction of cash flow. And cash flow is one of the most important financial concepts that you can master, because it is your cash flow pattern, not how much money you make, that determines whether you are rich , middle class or poor. The choices that you make with your money determine your cash flow pattern. Change your choices, change your cash flow pattern. Change your cash flow pattern, change your financial class.

The poor choose to spend all of their money on expenses. Living expenses, new toys, vacations, etc. I have seen people with six figure incomes have this cash flow pattern.

The Middle Class choose to spend their money on liabilities that siphon all of their money out the expense column. The more money they make the more debt they incur and the harder they have to work to pay for that debt.

The Rich also spend their money on expenses and liabilities, but in a different order than the poor and middle class. The rich FIRST CHOOSE to spend their money on ASSETS ( that put money in their pockets with out them having to continue to work hard) then they spend their money on expenses and lastly on liabilities.

And a personal favorite though not exclusively financial,

Dream Big And Then Go For It.

Let your dreams be your driving force . DREAM BIG!! Let your imagination shape your journey to creating your own reality and then TAKE ACTION! Do at least one thing every day to make that dream a reality. We hold our selves back by allowing other people to tell us what is possible or impossible. If you decide that you can do anything, then you CAN do anything. Henry Ford once said “ if you think you can or if you think that you can’t, you’re right”. Believe that you can, and then do it.

On one hand you have the “ money is the root of all evil” crowd who want to convince you that not having money is a sign of some sort of piety and that you should wear poverty proudly and not want for something more. The crowd that says I could’ve been rich, but I chose a more spiritual route. As if to say that you can not have money and be spiritual at the same time. If your family was like mine, you did not discuss money at home. Your parents’ incomes were a private matter that you were not privy to and, if you asked, would get you firmly put in your place. Money was a dirty thing that was scarce and hard to get. It required long hours at a place that you hated to go to with people you could not stand to be around. And family was a great thing, but having one meant never being financially free.

On the other hand there is the “lack of money is the root of all evil” crowd who know from experience the evil that the lack of money can cause a person to do. The crowd that says “I am rich” even when they are flat broke. The group of people whose actions reflect a desire to have more so that they can do more. Any one who believes that spiritual accomplishment can be run penniless has never had to fund a mission to a third world country or build a school in economically challenged area.

So which one is right? Neither. But what I have found is that the profound difference between the “haves” and “have-nots” lies exclusively with money. I’m not talking about the number of figures in your pay check or the balance in your check book. I’m talking about the attitude toward and understanding of money. The “haves” rarely make excuses for not having money; they find solutions to the problem and create money. The old adage “it takes money, to make money” is a fallacy for them. This group of people can make money from nothing with just their creativity and will power.

So what is this magic been that separates the “haves” from the “have-nots?” It is education, the financial education that you won’t get from any academic institution. You have to seek out and nurture this education out side of the standard school system. And you are never too young or too old to get this education.

While I could write volumes on the subject, and in fact there are hundreds upon hundreds of books on the different facets of money, let me give just a few financial truths.

Money DOES Grow On Trees.

You can literally find money nearly everywhere in everything. EBay is a prime example of this. EBay is a place where any one can sell their every day junk and make money or set up a virtual store and make money from nothing. This is just one example of how some one took an idea and turned it into a money tree that creates money with out them having to work harder. My daughter has a candy machine business; she spends maybe 10 minutes a week working at but makes her more money every month than she makes at her JOB. That machine is her money tree. Just like a real tree it took a little time to find the right spot with all the right conditions, to figure out what was the best “fruit” for that area and then to care for the “tree”. And just like a real tree, the money tree will continue to grow and provide long after you stop working hard on it.

Ask yourself, ‘what is, or could be my money tree?’ Now go grow it.

Your Banker Will NEVER Ask For Your School Report Card Or Ask To See Your Permanent Academic Record.

Once you finish your academic career, your report card and permanent record will mean very little. Yes, you may have a degree that qualifies you for a higher paying job…maybe. (65% of all college graduates do not obtain employment in their field of study.) And you will have a higher earning potential that some of your class mates who did not manage to obtain a degree…maybe. (The job market is flooded with college graduates who can not find a work in their field of study, so they end up in another field making less money.) But what will that piece of paper and tens of thousand of dollars really do for you? Consider this: information is doubling every eighteen months. At that rate by the third year of your four year degree, what you studied in years one and two will be obsolete. When you leave school, the report card that you received every quarter will no longer show you your progress and help you to realign your priorities. I have never once had an employer or any other person that I wished to do business with, ask to see my permanent academic record. I have never been turned down for a business deal because I failed 9th grade algebra or got suspended for fighting in the girls gym in the 7th grade. I have, however been asked for my work records by potential employers and I have been asked for my financial statements by banks and potential business partners. After you get out of school, your financial statements become your report card. I find it frightening that in a world where your financial statement is your real life report card, we are taught next to nothing about the subject of money in school.

Take your accountant to lunch and pick his or her brain. You will learn a lot just by talking and it will only cost you the price of a lunch.

You CAN Afford Anything That You Want

I hear every day from people all over the place four little words that hold them back so much more than they will probably ever realize. “I Can’t Afford It”

The word ‘can’t’ in that statement is an absolute to our wonderfully complex brains, which does something horribly restrictive. It sends our brains a signal that tells it “this is it, you don’t have to work any more, because there is nothing else to it. “I can’t afford it” is a statement which automatically causes the brain to stop working. What the “haves” do that the “have-nots” don’t do is add one word, change one word and change the order so that the brain begins to work and get creative. They ask a question…”How Can I Afford It?” We all have the ability to afford anything that we want; we just have to find the how.

Charity Does Come Back To You Multiplied

Imagine a twenty dollar bill in your hand and your fist closed tightly around it. Could some one get that money out of your hand? Yes, but not with out great difficulty. On the reverse of that, they could not very easily put more money into your hand either.

Now imagine that same twenty dollar bill lying in your open hand. It is easy for that money to be removed from your hand and just as easy to put more money into it.

When we are charitable, we open out hands and minds to increase our money making power as well as feeding our spirit. Generosity breeds an openness that allows us to receive the generosity of others.

Assets Put Money IN Your Pocket . (Not Matter What Your Banker Tells You)

One of the biggest reasons that accounting is confusing for most people is because it defines items in one way and classifies them in another. For example an asset, in its simplest definition is something that puts money in your pocket. And a liability takes money out of your pocket. However when we go to the bank and are asked to fill out a financial statement, things like TV’s , personal homes, personal vehicles are all listed under the asset column even though those items do not generate income and in fact take money out of your pocket every month for years and sometimes decades. The question is often debated as to whether or not a personal residence is an asset or a liability. To answer that question lets go back to the definitions of an asset and a liability. If an asset puts money in your pocket and a liability takes money from your pocket. And the cash flow pattern of your house looks like this:

Then your house is really a liability.

When your banker says that your home is an asset he/she is not lying, they are just not telling you whose asset it is. The illustration below explains this point.

JOB Is An Acronym

It stands for Just Over Broke. If all you have is just a job all you will ever be is just over broke.

Cash Flow Determines Your Financial Class And Your Choices Determine Your Cash Flow.

The illustration above contains red arrows that represent the direction of cash flow. And cash flow is one of the most important financial concepts that you can master, because it is your cash flow pattern, not how much money you make, that determines whether you are rich , middle class or poor. The choices that you make with your money determine your cash flow pattern. Change your choices, change your cash flow pattern. Change your cash flow pattern, change your financial class.

The poor choose to spend all of their money on expenses. Living expenses, new toys, vacations, etc. I have seen people with six figure incomes have this cash flow pattern.

The Middle Class choose to spend their money on liabilities that siphon all of their money out the expense column. The more money they make the more debt they incur and the harder they have to work to pay for that debt.

The Rich also spend their money on expenses and liabilities, but in a different order than the poor and middle class. The rich FIRST CHOOSE to spend their money on ASSETS ( that put money in their pockets with out them having to continue to work hard) then they spend their money on expenses and lastly on liabilities.

And a personal favorite though not exclusively financial,

Dream Big And Then Go For It.

Let your dreams be your driving force . DREAM BIG!! Let your imagination shape your journey to creating your own reality and then TAKE ACTION! Do at least one thing every day to make that dream a reality. We hold our selves back by allowing other people to tell us what is possible or impossible. If you decide that you can do anything, then you CAN do anything. Henry Ford once said “ if you think you can or if you think that you can’t, you’re right”. Believe that you can, and then do it.

Thursday, May 31, 2007

Preditory Real Estate Investing by Dannielle Fritz-MacDuff

Recently I have noticed an abundance of get rich with real estate ads in my email box and banners littering the Internet. While researching one in particular I found some information that disturbed me. I attended a web seminar hosted by NAWREI (national association of women real estate investors), listened to the presentation and viewed the PowerPoint presentation included. Through out the entire presentation, words like accumulating wealth, cash flow quadrant, investor and financial freedom were thrown around. All of these seemed on the surface to advocate financial education. This presentation insisted that the way to financial freedom was to invest in real estate property in growing areas in properties that held instant equity and gained in value over the next twenty years. However, I noticed that each investment property offered by this organization broke the cardinal rule of real estate investing.

It lost money every month.

When investing remember that the key to accumulating wealth is to buy assets.

The simplest definition of an asset is something that you own which puts money IN your pocket every month without you having to physically work for it and with out you having to give up ownership of the asset. A liability, takes money OUT of your pocket.

Take care not to fall prey to sales people claiming to be investors. Make your money in real estate when you buy. Not in equity, but spendable cash flow. In order for the investment to help you reach financial freedom, the income from the investment should produce cash flow(spendable money) after paying all of the expenses associated with the investment. An investment that requires you to take money out of your pocket every month and wait for the value to go up in order to get your money back is utilizing the "buy hold and pray method" of investing also known as speculation. This method of investing creates liabilities and requires the investor to buy the investment , hold on to it (while continuing to loose money) and pray that the investment will go up in value so that the investor can get his/her money back.

Don't let sales people smooth talk you into loosing money for the sake of investing. Continue to get educated and remember the cardinal rule "investments put money in your pocket".

Happy Investing

It lost money every month.

When investing remember that the key to accumulating wealth is to buy assets.

The simplest definition of an asset is something that you own which puts money IN your pocket every month without you having to physically work for it and with out you having to give up ownership of the asset. A liability, takes money OUT of your pocket.

Take care not to fall prey to sales people claiming to be investors. Make your money in real estate when you buy. Not in equity, but spendable cash flow. In order for the investment to help you reach financial freedom, the income from the investment should produce cash flow(spendable money) after paying all of the expenses associated with the investment. An investment that requires you to take money out of your pocket every month and wait for the value to go up in order to get your money back is utilizing the "buy hold and pray method" of investing also known as speculation. This method of investing creates liabilities and requires the investor to buy the investment , hold on to it (while continuing to loose money) and pray that the investment will go up in value so that the investor can get his/her money back.

Don't let sales people smooth talk you into loosing money for the sake of investing. Continue to get educated and remember the cardinal rule "investments put money in your pocket".

Happy Investing

Labels:

investing,

NAWREI,

Real Estate

Wednesday, May 23, 2007

Winning The Struggle With Poverty by Dannielle Fritz-MacDuff

Today's society has produced an astounding number of people who live by the entitlement standard. Our social services and welfare programs practice the "give a man a fish" method of solving problems rather than the "teach a man to fish" method. As a result the gap between the lower/middle class and the upper class or the "haves and have-nots" is getting exponentially wider as the years go on. Rather than teaching how to get yourself out of a financial rut, our government assistance programs become a trap where the more you try to help yourself, the less help you receive. For the most part, the assistance the people receive is monetary with little or no relevant education.

The problem is not really how much money the people have, but rather a lack of financial education and a lack of desire to make changes or fear of failure.

Poverty is caused by ignorance, and fed by fear and laziness.

We are not taught about money in school, the subject of money is taught at home. Opinions and understanding of money are passed down from generation to generation.

I say that poverty is caused by ignorance because there seems to be this common consensus that money is scarce or hard to get or that the only way to get money is to work hard for it. This point of view is accepted for two reasons; 1) our schools teach us to study hard so that we can get a good job, because with a good job we will be safe and secure and the company will take care of us, 2) we have been lead to believe that when we can not take care of our selves that the government will take care of us ( or more accurately, many of us believe that the government should take care of us). We have the Robin Hood mentality " make the rich pay for it, they can afford it." When people struggle financially, many will place the blame on the economy, business owners, someone, anyone other than themselves. I here people say " if only I had more money." or " I'm looking for a job that pays better." or "my boss is greedy and won't give me anymore money". This is said because the person believes that more money will solve their financial problems, when in reality more money rarely solves the problem because what is really causing the struggle is the person in control of spending the money, because that person is not financially educated. Not because the person is stupid or inferior, but because when it comes to money that person only knows what he/she has been taught by our school system (which is nothing) and at home ( which is to handle money the way that he/she handles money now because that is the only way they know and how it has been done by their family.).

Poverty is created by ignorance, the lack of financial education keeps us repeating the same financial mistakes generation after generation until someone chooses to break the cycle.

Poverty is fed by fear and laziness.

Fear first.

We are taught in school that there is only one right way to do something or one right answer to a question, one right way to solve a problem and if we deviate from that, then we are ridiculed or punished for not following the rules or being different. So we develop this fear that if we do something different and do not accomplish what we set out to do, then we will be a failure and be ridiculed by our peers and other people around us. We are afraid that if we admit that we do not know the answer, other people will think we are stupid because we are taught at school and as employee's that not knowing the answer is a bad thing. In school if we try to collaborate on a test, it is called cheating. In business, collaborating on a test is called synergistic problem solving and the teams get more accomplished than one person could on their own.

After fear is the laziness. It is much easier to not make the effort to learn something new that will help us than to face the fear of rejection or failure. And so the same pattern is repeated over and over again expecting different results , but never getting them because the same behaviour will garnish the same results. I hear things like " I can't do that. or I can't afford it. or I didn't go to the right school for that. or I don't have the time for that, or I don't want to waste the money on learning something new.

We often put our selves in the situation we are in by our choices. Either our choice of action or choice of reaction and rather than taking responsibility for our choices, we blame the economy, our boss, the government, or other persons in our relationships. we choose to discount learning opportunities or other opportunities out of fear or laziness and wonder why we don't seem to get ahead. We use industrial age financial education in the information age where information doubles every eighteen months. We study hard at college learning information in our first two years of school that is out dated by the third an fourth year. College advisers instruct students applying for jobs with information that was accurate 20 years ago but is not necessarily applicable for the student today. We teach our students to regurgitate facts and figures from history, but fail to teach the lessons history has to offer and in doing so create a society that sinks deeper and deeper into ignorance. By our methodology, we teach our students that they must have all of the right answers rather than teaching them to look for multiple, creative solutions to problems. We generally accept complaining about the problem rather than seeking solutions. And then after all of that, we penalize the products of our teaching by creating assistance programs that do not increase intellect but rather force people back into the fear and laziness mode. A person receiving government assistance is penalized by having more and more benefits taken away as that person works harder and harder to make the income that will make it possible for that person to be self reliant rather than relying on the government. These programs create an atmosphere of false security where people say " if I make more money, I will loose my assistance or benefits (I am afraid that if I loose my benefits I will not be able to survive), so it is easier to stay poor and get the hand out, than to create income and not need the benefits (laziness). Our government assistance programs reward lazy and ignorant behaviour by giving young single mothers more money for each child that they produce and added tax credits for poverty level income earners that becomes viewed as a paycheck. I have seen parents with several children come into my office with multiple w-2's totaling less than $12,000.00. These same people tell me that they stop working so that they will receive the maximum Earned Income Tax Credit which produces a larger refund. These people are making less than $12,000 per year before taxes, they don't get to take home 12,000.00 and choose to stop working for a measly 4000.00 addition to their tax refund. I see self employed people who don't take all of their allowed deductions because they want to get the maximum Earned Income Tax Credit, so they pay thousands of dollars more in taxes than they are required to and accept a two thousand dollar refund.

Our schools encourage cheating for students that struggle to learn the way that our schools teach by providing scribes who will write the answers for students who struggle with spelling and readers who read tests to students who struggle with reading so that the grades and standard test scores reach a higher average and the school will not risk loosing funding.

We breed poverty in our society and then tax the poor heavily to pay for the benefits that they receive.

We reward laziness with government benefits, threaten to take away those benefits if the person shows some hint of initiative and fail to educate our students adequately enough to serve them in the real world.

So what do we do about this? We continue to offer the education to those who will accept it, lobby for education reform and teach people to over come their fear of lack of money by showing them the tools available and teaching them how to use those tools. Encourage our children and students to fail on thier own merit in schools and learn from the experience rather than to be pushed through a system that does not prepare them for the real world. Make sure that our children and students are proficient at basic math first, then teach them the advanced math. Teach them to use proper grammer and to communicate effectively. Excellent math and communication skill are essential to our success.

The problem is not really how much money the people have, but rather a lack of financial education and a lack of desire to make changes or fear of failure.

Poverty is caused by ignorance, and fed by fear and laziness.

We are not taught about money in school, the subject of money is taught at home. Opinions and understanding of money are passed down from generation to generation.

I say that poverty is caused by ignorance because there seems to be this common consensus that money is scarce or hard to get or that the only way to get money is to work hard for it. This point of view is accepted for two reasons; 1) our schools teach us to study hard so that we can get a good job, because with a good job we will be safe and secure and the company will take care of us, 2) we have been lead to believe that when we can not take care of our selves that the government will take care of us ( or more accurately, many of us believe that the government should take care of us). We have the Robin Hood mentality " make the rich pay for it, they can afford it." When people struggle financially, many will place the blame on the economy, business owners, someone, anyone other than themselves. I here people say " if only I had more money." or " I'm looking for a job that pays better." or "my boss is greedy and won't give me anymore money". This is said because the person believes that more money will solve their financial problems, when in reality more money rarely solves the problem because what is really causing the struggle is the person in control of spending the money, because that person is not financially educated. Not because the person is stupid or inferior, but because when it comes to money that person only knows what he/she has been taught by our school system (which is nothing) and at home ( which is to handle money the way that he/she handles money now because that is the only way they know and how it has been done by their family.).

Poverty is created by ignorance, the lack of financial education keeps us repeating the same financial mistakes generation after generation until someone chooses to break the cycle.

Poverty is fed by fear and laziness.

Fear first.

We are taught in school that there is only one right way to do something or one right answer to a question, one right way to solve a problem and if we deviate from that, then we are ridiculed or punished for not following the rules or being different. So we develop this fear that if we do something different and do not accomplish what we set out to do, then we will be a failure and be ridiculed by our peers and other people around us. We are afraid that if we admit that we do not know the answer, other people will think we are stupid because we are taught at school and as employee's that not knowing the answer is a bad thing. In school if we try to collaborate on a test, it is called cheating. In business, collaborating on a test is called synergistic problem solving and the teams get more accomplished than one person could on their own.

After fear is the laziness. It is much easier to not make the effort to learn something new that will help us than to face the fear of rejection or failure. And so the same pattern is repeated over and over again expecting different results , but never getting them because the same behaviour will garnish the same results. I hear things like " I can't do that. or I can't afford it. or I didn't go to the right school for that. or I don't have the time for that, or I don't want to waste the money on learning something new.

We often put our selves in the situation we are in by our choices. Either our choice of action or choice of reaction and rather than taking responsibility for our choices, we blame the economy, our boss, the government, or other persons in our relationships. we choose to discount learning opportunities or other opportunities out of fear or laziness and wonder why we don't seem to get ahead. We use industrial age financial education in the information age where information doubles every eighteen months. We study hard at college learning information in our first two years of school that is out dated by the third an fourth year. College advisers instruct students applying for jobs with information that was accurate 20 years ago but is not necessarily applicable for the student today. We teach our students to regurgitate facts and figures from history, but fail to teach the lessons history has to offer and in doing so create a society that sinks deeper and deeper into ignorance. By our methodology, we teach our students that they must have all of the right answers rather than teaching them to look for multiple, creative solutions to problems. We generally accept complaining about the problem rather than seeking solutions. And then after all of that, we penalize the products of our teaching by creating assistance programs that do not increase intellect but rather force people back into the fear and laziness mode. A person receiving government assistance is penalized by having more and more benefits taken away as that person works harder and harder to make the income that will make it possible for that person to be self reliant rather than relying on the government. These programs create an atmosphere of false security where people say " if I make more money, I will loose my assistance or benefits (I am afraid that if I loose my benefits I will not be able to survive), so it is easier to stay poor and get the hand out, than to create income and not need the benefits (laziness). Our government assistance programs reward lazy and ignorant behaviour by giving young single mothers more money for each child that they produce and added tax credits for poverty level income earners that becomes viewed as a paycheck. I have seen parents with several children come into my office with multiple w-2's totaling less than $12,000.00. These same people tell me that they stop working so that they will receive the maximum Earned Income Tax Credit which produces a larger refund. These people are making less than $12,000 per year before taxes, they don't get to take home 12,000.00 and choose to stop working for a measly 4000.00 addition to their tax refund. I see self employed people who don't take all of their allowed deductions because they want to get the maximum Earned Income Tax Credit, so they pay thousands of dollars more in taxes than they are required to and accept a two thousand dollar refund.

Our schools encourage cheating for students that struggle to learn the way that our schools teach by providing scribes who will write the answers for students who struggle with spelling and readers who read tests to students who struggle with reading so that the grades and standard test scores reach a higher average and the school will not risk loosing funding.

We breed poverty in our society and then tax the poor heavily to pay for the benefits that they receive.

We reward laziness with government benefits, threaten to take away those benefits if the person shows some hint of initiative and fail to educate our students adequately enough to serve them in the real world.

So what do we do about this? We continue to offer the education to those who will accept it, lobby for education reform and teach people to over come their fear of lack of money by showing them the tools available and teaching them how to use those tools. Encourage our children and students to fail on thier own merit in schools and learn from the experience rather than to be pushed through a system that does not prepare them for the real world. Make sure that our children and students are proficient at basic math first, then teach them the advanced math. Teach them to use proper grammer and to communicate effectively. Excellent math and communication skill are essential to our success.

Thursday, May 17, 2007

Thursday, May 3, 2007

It's a Matter of Training- Why The Rich Are Getting Richer While The Poor Get Poorer by Dannielle Fritz-MacDuff

One of the reasons that so many of us struggle financially is because we are trained to work hard for money rather than to look for opportunities that will make our money work hard for us.

All through out our academic careers we are trained to get good grades so we can get into a good college and a college education will get us a good job. With a good job we can work for 30 or 40 years and retire with a golden parachute and a pension plan. During most of our adult lives, we are taught to go out and get a job. There is the common consensus that getting a job is the only way to get money. We are trained through out our lives to look for jobs. The problem with this training is that a person's financial potential is limited to the amount of time a person physically works. If the person does not work, the person does not get paid. In addition, when you work for money, you are partnering with the government. With your time, you earn the money and then the government takes thier part before you even see the fruits of your labor. The government's share can be up to 48% just to the federal government when we add in state and local taxes, the government share of your hard earned money can be as much as 60% . It is much harder to get ahead financially when you are working hard and only getting to use 40% of what you have earned.

Our schools, society and ,many times, our families train us to work hard for money. The key to getting off of this financial hamster wheel is to retrain your mind to look for opportunities rather than looking for a job.

Have you ever noticed that when you are looking for a specific type of car, suddenly that car is everywhere? When you are looking for a new home, you begin to see for sale or for rent signs everywhere. When you want a job, you find a job.

If you want more financial control, you have to retrain your brain to look for opportunities that make money for you, with out a lot of time or effort from you rather than looking for a job.

The opportunity of a lifetime comes along about once everyday. If a person takes the time to retrain his/her brain to look for opportunities rather than look for a job, opportunities will begin to pop up everywhere.

I have a challenge for you:

Spend one hour everyday looking for an opportunity. You do not have to spend one hour all at once. Spend 10 minutes looking through the classified adds or driving a different way to drop the kids off at school. Take note of opportunities during your regular routine.

The opportunities that you find will be your opportunities and different from my opportunities. Your opportunities will come a combination of your creativity and what you see.

Then persue those opportunities. Do not let what you see limit your potential.

Forget the idea that there is only one right answer to any given situation. Rather than saying 'I can't do that because I don't have this.' Ask yourself 'How can I do that?'

Happy Hunting.

All through out our academic careers we are trained to get good grades so we can get into a good college and a college education will get us a good job. With a good job we can work for 30 or 40 years and retire with a golden parachute and a pension plan. During most of our adult lives, we are taught to go out and get a job. There is the common consensus that getting a job is the only way to get money. We are trained through out our lives to look for jobs. The problem with this training is that a person's financial potential is limited to the amount of time a person physically works. If the person does not work, the person does not get paid. In addition, when you work for money, you are partnering with the government. With your time, you earn the money and then the government takes thier part before you even see the fruits of your labor. The government's share can be up to 48% just to the federal government when we add in state and local taxes, the government share of your hard earned money can be as much as 60% . It is much harder to get ahead financially when you are working hard and only getting to use 40% of what you have earned.

Our schools, society and ,many times, our families train us to work hard for money. The key to getting off of this financial hamster wheel is to retrain your mind to look for opportunities rather than looking for a job.

Have you ever noticed that when you are looking for a specific type of car, suddenly that car is everywhere? When you are looking for a new home, you begin to see for sale or for rent signs everywhere. When you want a job, you find a job.

If you want more financial control, you have to retrain your brain to look for opportunities that make money for you, with out a lot of time or effort from you rather than looking for a job.

The opportunity of a lifetime comes along about once everyday. If a person takes the time to retrain his/her brain to look for opportunities rather than look for a job, opportunities will begin to pop up everywhere.

I have a challenge for you:

Spend one hour everyday looking for an opportunity. You do not have to spend one hour all at once. Spend 10 minutes looking through the classified adds or driving a different way to drop the kids off at school. Take note of opportunities during your regular routine.

The opportunities that you find will be your opportunities and different from my opportunities. Your opportunities will come a combination of your creativity and what you see.

Then persue those opportunities. Do not let what you see limit your potential.

Forget the idea that there is only one right answer to any given situation. Rather than saying 'I can't do that because I don't have this.' Ask yourself 'How can I do that?'

Happy Hunting.

Tuesday, April 24, 2007

Tracking For Financial Fitness

Imagine a Weight Watcher's meeting with no scale, no food journals, no accountability. How would you gage your progress. It's Impossible to really show significant impact on your financial life with out any controls. Tracking your income and expenditures is vital for Financial Fitness. The actions of recording and reviewing your financial information with an unbiased approach makes introducing new behaviors easier and quantifies the change. Consider for instance the amount of money that you spend on dining out each month. With out tracking this expense it would be impossible to know exactly how much you are spending and it is easy to spend a lot on expenses like this, because the amount that gets doled out at each restaurant is nominal. However these expenses tend to add up quickly. For example imagine that you stop for a quick breakfast and coffee each morning and and that that breakfast costs you an average of $4.00 each day. Also, at lunch time you go out for a quick pick-me-up lunch that costs you an average of $6.00 per day. If you work 5 days per week, this cost you roughly $217.00 per month ($10.00 per day time five days per week time 52 weeks per year divided by 12 months) or a whopping $2600.00 per year. may of us spend much more than this just on meals out not to mention other small incidentals and often end up wondering where our money went to.

It is crucial that you know where ALL of your money is going to if you want to be in control of your financial life. Take a minute each day to list all of your income and expenses and the tally up what you are spending on incidental items. How could you eliminate some of that expense? Could you pack your lunch twice a week (at an approximate savings of $624.00 per year)? Or perhaps, you could make a breakfast at home in the morning (approximately $1040.00 per year saved).

There are literally hundreds of places to find hidden money, but with out tracking your income and expenses you will not have the information necessary to find these hidden treasures or to take action.

It is crucial that you know where ALL of your money is going to if you want to be in control of your financial life. Take a minute each day to list all of your income and expenses and the tally up what you are spending on incidental items. How could you eliminate some of that expense? Could you pack your lunch twice a week (at an approximate savings of $624.00 per year)? Or perhaps, you could make a breakfast at home in the morning (approximately $1040.00 per year saved).

There are literally hundreds of places to find hidden money, but with out tracking your income and expenses you will not have the information necessary to find these hidden treasures or to take action.

Labels:

Hidden Money,

taking financial control

Wednesday, April 11, 2007

Check Out This Pod Cast On Internet Marketing

I found this blog while searching for information on Rich Dad. The pod cast was very insightfull and I gleaned alot of great ideas and inspiration from it. This pod cast contains a lot of useful information for anyone looking to create income on the internet.

http://www.internet-based-business-mastery.com/ibm-26-the-secret-mindset-needed-to-get-started-as-an-internet-business-master

http://www.internet-based-business-mastery.com/ibm-26-the-secret-mindset-needed-to-get-started-as-an-internet-business-master

P3I Investing Strategy of the Month- Financial Starting Point by Dannielle Fritz-MacDuff

We began the P3I investing workshops as a tool for our clients to take back control of their financial future and empower each customer to reach their goals and achieve their dreams. So I thought adding one strategy each month to this blog would be helpful to others.

Financial Starting Point-

Most of us know how to plan a road trip. Start with where you are and mark out a path on the road map. If you run into a road block, re-route and keep moving forward.

This simple strategy is the best way to start a financial journey as well.

What I find is that often clients do not know where they really stand financially and many are afraid to find out. It is much less traumatizing to go along semi - ignorant of what our financial snapshot looks like, than to get in and be brutally honest about how much money we spend or borrow. This fear of what the real picture of our financial lives looks like is what holds most of us back and leaves the money in control of our actions. P3I investing is about putting the person in control of the money through action.

Start with one day and all of your financial information.-do a "brain dump" and list all of your income and where it comes from.

Next list all of your liabilities ( everything and everyone that you owe money to.) and the total balance due for each bill. Be brutally honest in this step, if you leave out the loan from uncle Jim or the doctor bill that is lowering your credit score, you will sell yourself short and set yourself up for failure.

List all of your expenses including monthly payments for each liability. Don't forget to include miscellaneous living expenses like toiletries and food. Also make sure you include a realistic expense for things like; entertainment, salon visits, clothing and other items that are just part of life.

Now List every thing that you own - if you had to give a list to an insurance adjuster because your home burned to the ground and you lost everything, what would be on that list. Go through your home and catalog everything that you own and assign a dollar value to these items. Also include things like cash in the bank, stocks, bonds, real estate owned, businesses that you own and other intangible assets.

Now set that aside and we will come back to it. For the next two weeks, carry a small notebook and pen or pencil with you and write down everything that you purchase or spend your money for. Include expenditures for things as small as a piece of gum form the candy machine. At the end of the two weeks go back and tally all of your expendituture by like expenses. This may sound daunting, but it will give you a place where you can review where your money is going and make you more conscious of where you are actually spending your money, which puts you back in control. That control allows you to make your money work for you instead of constantly working harder for money.

I am not saying that you will be able to quit your job tomorrow, or maybe you will. That is really up to you. But if you start here and consistently do five things, you will be able to make yourself financially free in 10-15 years. 10 -15 years is relatively fast if you consider that most of us work at our jobs for 40 plus years. Here are the five things that you MUST do to make yourself financially free:

Learn something new and useful everyday- the key word hear is useful. If you can not apply this knowledge, it is just taking up space in your brain. Don't get me wrong, interesting trivia definitely has its uses and can be fun, but learning something about your money that puts you in the drivers seat will help you have more time for the fun stuff

Know your exit strategy- why do you want to be financially free? The why is so much more than the how because the why drives us. The why makes us get out of bed in the morning and the why keeps us moving forward when it looks like it is all about to hit the fan. After the why comes the when- Complete this sentence -I will have made it when... . That when is your exit strategy.

Find a friend to hold you accountable and then ...lie. I don't mean start telling outlandish lies about what you are doing. I mean start telling people what you are working on. Since you have not actually accomplished your goal yet it is technically a lie and not fact. we lie to our selves everyday when we say things like "I could never do that" or "You can't do that here" or "I'll never be rich" and those lies hold us back because we believe them. so why not lie about the opposite and watch it come true. If you tell someone about your plans, you are three times more likely to succeed because you will subconsciously work harder at the project to save face. Get someone to be your success partner and ask them to talk to you once a week to check in and see how things are going.

Choose to be financially free - This sounds easy, but the trick is to make that choice everyday and then carry that choice over to the choices we make when we spend our money. Choose to spend your money on your education and on things that will continue to put moeny in your pocket even if you stop working.

And finally, Take Action - you have to act to make things happen. Just talking about becoming financially free is not enough, you have to begin taking steps to get to your goal. Do something, even if it is wrong. If you make a mistake, then at least you have learned something, even if it is what not to do.

Thanks for visiting our blog. Look for more P3I investing strategies coming soon and check our web site, we will be posting down loadable worksheets to help you with this strategy.

Financial Starting Point-

Most of us know how to plan a road trip. Start with where you are and mark out a path on the road map. If you run into a road block, re-route and keep moving forward.

This simple strategy is the best way to start a financial journey as well.

What I find is that often clients do not know where they really stand financially and many are afraid to find out. It is much less traumatizing to go along semi - ignorant of what our financial snapshot looks like, than to get in and be brutally honest about how much money we spend or borrow. This fear of what the real picture of our financial lives looks like is what holds most of us back and leaves the money in control of our actions. P3I investing is about putting the person in control of the money through action.

Start with one day and all of your financial information.-do a "brain dump" and list all of your income and where it comes from.

Next list all of your liabilities ( everything and everyone that you owe money to.) and the total balance due for each bill. Be brutally honest in this step, if you leave out the loan from uncle Jim or the doctor bill that is lowering your credit score, you will sell yourself short and set yourself up for failure.

List all of your expenses including monthly payments for each liability. Don't forget to include miscellaneous living expenses like toiletries and food. Also make sure you include a realistic expense for things like; entertainment, salon visits, clothing and other items that are just part of life.

Now List every thing that you own - if you had to give a list to an insurance adjuster because your home burned to the ground and you lost everything, what would be on that list. Go through your home and catalog everything that you own and assign a dollar value to these items. Also include things like cash in the bank, stocks, bonds, real estate owned, businesses that you own and other intangible assets.

Now set that aside and we will come back to it. For the next two weeks, carry a small notebook and pen or pencil with you and write down everything that you purchase or spend your money for. Include expenditures for things as small as a piece of gum form the candy machine. At the end of the two weeks go back and tally all of your expendituture by like expenses. This may sound daunting, but it will give you a place where you can review where your money is going and make you more conscious of where you are actually spending your money, which puts you back in control. That control allows you to make your money work for you instead of constantly working harder for money.

I am not saying that you will be able to quit your job tomorrow, or maybe you will. That is really up to you. But if you start here and consistently do five things, you will be able to make yourself financially free in 10-15 years. 10 -15 years is relatively fast if you consider that most of us work at our jobs for 40 plus years. Here are the five things that you MUST do to make yourself financially free:

Learn something new and useful everyday- the key word hear is useful. If you can not apply this knowledge, it is just taking up space in your brain. Don't get me wrong, interesting trivia definitely has its uses and can be fun, but learning something about your money that puts you in the drivers seat will help you have more time for the fun stuff

Know your exit strategy- why do you want to be financially free? The why is so much more than the how because the why drives us. The why makes us get out of bed in the morning and the why keeps us moving forward when it looks like it is all about to hit the fan. After the why comes the when- Complete this sentence -I will have made it when... . That when is your exit strategy.

Find a friend to hold you accountable and then ...lie. I don't mean start telling outlandish lies about what you are doing. I mean start telling people what you are working on. Since you have not actually accomplished your goal yet it is technically a lie and not fact. we lie to our selves everyday when we say things like "I could never do that" or "You can't do that here" or "I'll never be rich" and those lies hold us back because we believe them. so why not lie about the opposite and watch it come true. If you tell someone about your plans, you are three times more likely to succeed because you will subconsciously work harder at the project to save face. Get someone to be your success partner and ask them to talk to you once a week to check in and see how things are going.

Choose to be financially free - This sounds easy, but the trick is to make that choice everyday and then carry that choice over to the choices we make when we spend our money. Choose to spend your money on your education and on things that will continue to put moeny in your pocket even if you stop working.

And finally, Take Action - you have to act to make things happen. Just talking about becoming financially free is not enough, you have to begin taking steps to get to your goal. Do something, even if it is wrong. If you make a mistake, then at least you have learned something, even if it is what not to do.

Thanks for visiting our blog. Look for more P3I investing strategies coming soon and check our web site, we will be posting down loadable worksheets to help you with this strategy.

Thursday, April 5, 2007

How To Work The System Instead Of Beating The System by Dannielle Fritz-MacDuff

As an accountant and financial educator I have been asked countless times how to beat the tax system. After all, our largest expense in life is our tax bill. We are taxed when we earn, taxed when we spend, taxed when we save and taxed when we die. So how does a person, the average working Joe, "beat the system"? The simple answer is... you don't. Instead, learn to work the system. I have included some things that you can do that will help you make the system work to your advantage.

Talk to a tax professional.

Interview several tax professionals, not all accountants and tax agencies are created equal. Much like lawyers, accountants tend to specialize. Find one that is competent and willing to put forth an effort and guide you. You tax advisor should be up to date with the latest tax loopholes and requirements as well as being a forward thinker. A forward thinking tax advisor will be able to help you create a workable strategy that is proactive and takes advantage of every possible loophole available to you and advise you on what changes could be made that will open up additional loopholes.

Change how you make your income.

This does NOT mean quit your job. Instead look for and take advantage of opportunities that will move your money from earned income, which is the most highly taxed income with the fewest allowed loopholes, to passive income. Passive income allows multiple loopholes and is taxed on a completely separate set of rules.

When you make your money from a job as an employee the tax rules in their simplest form look like this:

EARN ---- TAXED ON ALL OF IT ----- SPEND WHAT'S LEFT

When you make your money from investments that are working for you, this is passive income. The tax rules in their simplest form for passive income look like this:

EARN---- SPEND WHAT YOU NEED TO SPEND ---- TAXED ON WHAT IS LEFT

Most of us are only using the first tax strategy and making all of our money as employees. Converting that earned(employee) income into passive income will allow you to take advantage of the second tax strategy which puts you in control of your financial future your tax bill.

Monitor and control your expenses

I am not preaching "live below your means, cut up your credit cards and don't use debt". Instead pay attention to where you are spending your money. We all should live the good life. what ever your good life may be. When you pay attention to where your money is going, this gives you more control. Controlling your expenses simply means making wise choices. Most of us get caught in the consumer craze. We spend millions every year on credit card interest and don't use those credit cards to our advantage. Instead we choose to buy things that require us to work harder to pay for the stuff that we want instead of first buying the things that will put money into our pockets that can pay for our toys. Instead use credit to your advantage. Use other people's money to buy your investments and assets that are making money for you. If you are using other people's money to make money for you, your return on investment is infinate.

ex. you purchase a rental property for $5000.00 using an advance from your credit card. After all of the expenses are deducted from the rental income (including your credit card payment) you have 200.00 left over every month. Your rate of return =cashflow from the investment(profit) devided by the cash that you put into the investment (0 of your own money). That return is infinate and you do not have to pay back the debt, your tenant pays that for you.

Pay Yourself First!

Don't dip into your savings when times get tough. Let the pressure build up and motivate you to think outside of the box to find ways to make more money. Then use that savings to buy investments or assets that put money in your pocket. These sources of income will be there even if you loose your job.

Talk to a tax professional.

Interview several tax professionals, not all accountants and tax agencies are created equal. Much like lawyers, accountants tend to specialize. Find one that is competent and willing to put forth an effort and guide you. You tax advisor should be up to date with the latest tax loopholes and requirements as well as being a forward thinker. A forward thinking tax advisor will be able to help you create a workable strategy that is proactive and takes advantage of every possible loophole available to you and advise you on what changes could be made that will open up additional loopholes.

Change how you make your income.

This does NOT mean quit your job. Instead look for and take advantage of opportunities that will move your money from earned income, which is the most highly taxed income with the fewest allowed loopholes, to passive income. Passive income allows multiple loopholes and is taxed on a completely separate set of rules.

When you make your money from a job as an employee the tax rules in their simplest form look like this:

EARN ---- TAXED ON ALL OF IT ----- SPEND WHAT'S LEFT

When you make your money from investments that are working for you, this is passive income. The tax rules in their simplest form for passive income look like this:

EARN---- SPEND WHAT YOU NEED TO SPEND ---- TAXED ON WHAT IS LEFT

Most of us are only using the first tax strategy and making all of our money as employees. Converting that earned(employee) income into passive income will allow you to take advantage of the second tax strategy which puts you in control of your financial future your tax bill.

Monitor and control your expenses

I am not preaching "live below your means, cut up your credit cards and don't use debt". Instead pay attention to where you are spending your money. We all should live the good life. what ever your good life may be. When you pay attention to where your money is going, this gives you more control. Controlling your expenses simply means making wise choices. Most of us get caught in the consumer craze. We spend millions every year on credit card interest and don't use those credit cards to our advantage. Instead we choose to buy things that require us to work harder to pay for the stuff that we want instead of first buying the things that will put money into our pockets that can pay for our toys. Instead use credit to your advantage. Use other people's money to buy your investments and assets that are making money for you. If you are using other people's money to make money for you, your return on investment is infinate.

ex. you purchase a rental property for $5000.00 using an advance from your credit card. After all of the expenses are deducted from the rental income (including your credit card payment) you have 200.00 left over every month. Your rate of return =cashflow from the investment(profit) devided by the cash that you put into the investment (0 of your own money). That return is infinate and you do not have to pay back the debt, your tenant pays that for you.

Pay Yourself First!

Don't dip into your savings when times get tough. Let the pressure build up and motivate you to think outside of the box to find ways to make more money. Then use that savings to buy investments or assets that put money in your pocket. These sources of income will be there even if you loose your job.

Saturday, March 31, 2007

Why Real Estate? by Dannielle Fritz-MacDuff

I was having dinner with my parents at our last visit to their home and of course the subject of money and investing came up. (occupational hazard) My youngest sister and her husband asked my what would be the best investment for some money that they are expecting to receive. This is a loaded question, since the best investment strategy for me may not be the best investment strategy for someone else's situation and temperament. So I decided to explain the merits of the different asset classes and what I liked about each. We spent most of our conversation on real estate.

So, why real estate?

Real estate is one of the most tax advantaged investments as well as an investment that gives maximum control to the owner.

Imagine an investment that you can obtain with literally none of your own money, goes up in value, allows you to get your money back with out relinquishing control of the investment, and allows you to put money in your pocket tax free?

These are just a few of the advantages of real estate.

Real Estate can be very profitable. Rental income covers all of your expenses so your tenant pays for your debt and expenses. It is possible to finance 100% of your purchase price ( or even more than 100% of the purchase price and get cash back at closing). Rental income that exceeds all of the expenses lets you get your money back faster than selling the property and puts money into your pocket every month. That's spendable income every month and you still have control over the investment. Can you do that with stocks or bonds or t-bills or a 401k or an IRA? Not really. You can refinance a piece of real estate to provide additional investment capital without giving up control of the investment.

The government give incentives to owners of rental properties. Since real estate investors are providing affordable housing for people who would otherwise not be able to afford a home, the government allows the investor this simplified tax strategy. EARN, SPEND, GET TAXED ON WHAT'S LEFT. The government also gives you a deduction for depreciation on real estate that produces income. Depreciation is an allowance for property that looses value. Real Estate is not known for loosing value, as a mater of fact it is know as an asset that increases in value or appreciates.